Well, that was an interesting week. We started the week talking about policy rates in the US going to potentially 6% and finished talking about bank bailouts. Quite remarkable.

The much-anticipated non-farm payroll (NFP) number and corresponding labor market data were undermined by the situation at Silicon Valley Bank (SVB). The data seemed mixed to me by the way. A decent headline payroll print, but unemployment increased to 3.6% from 3.4% and Average Hourly Earnings came in lower than expected. We didn’t get the major revisions that some may have been hoping for. Something for both bulls and bears.

My mediocre understanding of the SVB situation is as follows: SVB is the 16th largest bank in the United States whose main depositors are the Venture Capital (VC) and Private Equity (PE) sector. The bank was formed in the 1980s with deposits doubling between 2020 and 2021. A large portion of deposits found their way into long dated fixed income securities. As rates went up, the mark-to-market loss on these holdings increased, almost matching the bank’s equity capital. However, the securities were being accounted for in such a way that losses were not realized. In a meeting with Moody’s, the rating agency, SVB was informed that they could be in for a multi-notch downgrade given their financial position. This could result in deposit flight and an inevitable bank run. A decision was made to sell the fixed income portfolio, crystallize a loss and bridge the loss with a capital raise. This saw the share price plummet and expedited depositor withdrawals. Within 48 hours, the planned equity offering had been withdrawn due to further falls in the stock price, resulting in the bank being taken over by the FDIC and deposits frozen. SVB is currently trying to seek a buyer for either parts of it or the entire entity.

I wanted to spend some time thinking about 3 areas: how this happened, what the impacts will be and where we go from here.

When rates were taken to the zero lower bound across the world in 2008, there were serious questions raised about the consequences of doing so. However, none materialized. Once QE was introduced as a policy tool, questions surfaced around spiraling inflation through excess money-printing. Again, it seemed that there was no cost to endless money printing and our policy makers could get away with it. Indeed, it became a panacea to every problem we faced. Even a global pandemic was partly addressed through the lowering of interest rates and increased fiscal spending. Easy monetary and fiscal policy combined with supply-chain bottlenecks, sprinkled with a conflict between Russia/Ukraine ultimately released the inflation genie placing us in the position that we currently find ourselves in.

More alarming to me however was the behavioral biases that were being developed amongst market participants and policy makers. The former believing that rates will stay low forever and adjusted investment portfolios to go further out the risk spectrum to obtain returns. This saw higher growth in the tech space. The policy makers developed a God-like complex where no problem was insoluble and lower rates and QE could be administered ad infinitum with no visible cost.

The behavioral bias is what I believe contributed to SVB’s fatal error. There was no belief that rates could ever go up, let alone see one of the fastest hiking cycles in US monetary policy history. There was also a belief that the tech/PE/VC space could grow indefinitely.

Yet looking at what fixed income assets did on Friday, it seems the market is now suggesting that the Federal Reserve will cut rates by the end of this year. It seems very strange to me that the solution to the problem is the very thing that contributed to the behavior that led to the problem in the first place (try saying that quickly!).

Stories abound of the anecdotal impact of higher rates. I think we are all familiar with the higher rates leads to recession narrative. The rapidity of the breakdown of SVB and it being on US soil, seems to be making the cost of higher rates very real all of a sudden. Those lagged impacts of higher rates may be coming home to roost. However, the reality is that people have been suffering from inflation and negative real rates around the world for years. The implication is that asset holders have benefitted at the hands of a majority that do not with the social impacts that entails. Come to my neighborhood and tell people the cost of living has increased by 10% and they will laugh at you. The real cost people have been feeling on the street is much higher than what any CPI number will tell you.

I do not think that we are on the cusp of a banking crisis. There are many similarities to the setup we are facing when compared to 2007. We have seen large money managers put up gates to prevent redemptions from their real estate funds. Silvergate and now SVB are getting into trouble. Analogous to countrywide and Bear Stearn’s hedge funds getting into bother prior to the crisis ensuing. At the time we dismissed these smaller issues as being important but not reflective of systematic issues. This was proven to be woefully inaccurate. However, there are also many differences.

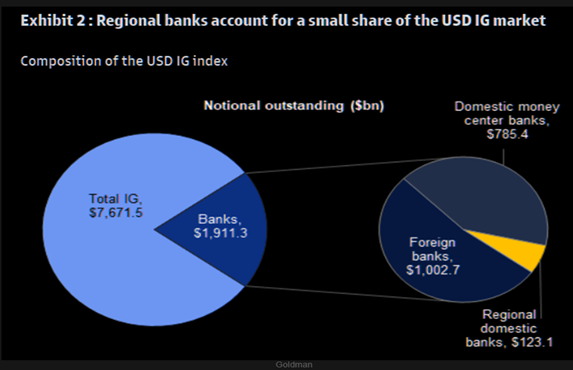

SVB lent to the VC and PE sectors primarily. This was a niche position that contributed to both it’s success and eventual downfall. Though the PE and VC sectors increased in size as rates remained at low levels, this strategy was not adopted by the whole banking sector. This is unlike mortgage back securities which were traded and created by pretty much all wall street banks prior to 2007. The chart below courtesy of Goldman Sachs via The Market Ear provides a sense on how big the regional banking sector is relative to the US investment grade market:

Where I think the true risk lies is in contagion. Though SVB is small, the issue it faced isn’t isolated. It may not prevent depositors at other banks rushing to make withdrawals in fear of their bank facing the same issue. This can start mass bank runs which can push other banks into the same position. This is very hard to pre-empt as it is a change in depositor psychology. By the time it is underway, it is too late. But I do think there is a solution that may alleviate this risk.

Depositors receive very little if any interest on their accounts. Though policy rates have increased substantially, this is not being passed onto them. You will certainly feel it if you try to get a mortgage though. This ability for banks to borrow at 0% and lend at whatever rate they like is blatantly problematic. Why keep money in an account earning nothing when treasury bills earn 5% (well they did prior to Friday 😊 ). Depositors now have very real choices to make with where they put their money. This rate differential has seen net interest margins increase. This is great for banks and shareholders but leaves the person on the street somewhat behind. Indeed, we have an issue of transmission rather than solvency in many cases. It would not surprise me if the FED moved to increase rates of interest on bank accounts going forward once it has dealt with SVB.

I do not think that the FED and other agencies will allow SVB to become systemic. The political damage that would be done by allowing a small bank to cause a catastrophe is not worth the headache. Perhaps they cannot do anything about it becoming systemic, but I think the odds of this getting completely out of hand is very low. This should leave us to return to data watching, which for the most part has not showed any signs of the recession many have been predicting.

Play a game with me. I do love thought experiments, so let’s say there will be a mass deposit withdrawal in the US. Those of us who trade EM have a good understanding of how that goes. Usually overnight rates get jacked massively to encourage people to keep deposits in accounts and prevent bank runs. This is also done to stop the currency devaluing and further encouraging capital flight. Hungary, Russia and Turkey are very good examples of where this has been done in the recent past. Granted, the reasons for doing so maybe different but the reaction function will be the same. Indeed on Friday, we saw the dollar weaken and most interestingly to me, real assets started to trade well. Oil, gold, and silver all traded up on the day. Some may argue this may be due to lower rates. But if we take this to the extreme scenario that I think some pundits are calling for, where would a person put their money. Real assets should do well.

One thing also becomes very clear to me, rates (yields) may not go down in this situation. The playbooks of 2007/2008 tell you that being long bonds is the right trade. I would argue that the origin of a problem in this instance is different and so the solution may not be the same.

Two other stories piqued my interest on Friday away from SVB. One was this headline:

URGENT: Iran, Saudi Arabia agree to resume ties, with China’s help

It’s on Bloomberg so it must be true! Just kidding. This was later confirmed with embassies of the respective countries being opened in the coming months. A pretty amazing geopolitical change that I feel has received very little airtime. It also begs the question of what role the US will now play in the Middle East going forward. China’s ability to negotiate this should receive much praise in my view. Peace is always a good thing and should be celebrated.

We have seen record purchases of gold from central banks last year and this continues into this year. I think many central banks were alarmed at how Russia’s dollar assets were frozen/seized/confiscated. Whether this was correct or not is another debate, but I can imagine the thought process bankers in other countries are going through. Any action that is carried out which the US deems as being inappropriate could see assets seized with no arbiter. The realization that they can be taken away at any time is not a comfortable position to be in.

I missed the below as well (apologies readers):

https://www.reuters.com/markets/commodities/russia-plans-deep-march-oil-export-cuts-sources-2023-02-22/

Taken in a collective, you have global political axis shifting, with actions that suggest the further undermining of the US dollar and more oil supply cuts to come from Russia. The geopolitical angle has been all but forgotten in investor’s decision making functions. If you combine geopolitics with the domestic issues the FED may face, you have an extremely complicated decision-making function. I think people have forgotten the FED or any other central bank does not make decisions in a vacuum. The FED’s job will become increasingly difficult.

In summary my thoughts are as follows:

• No banking crisis from SVB

• FED policy > 6%.

• Oil prices/real asset prices higher

• Dollar lower

Good luck to all!

Quay Partners Group is a service-as-a-platform investment management solutions for independent hedge fund managers and family offices.

Supun Ekanayake is a Partner at Quay Partners Investments (UK) LLP and has over 15 years’ experience trading across all asset classes.