As portfolio managers we often rely on narratives to guide our decision-making process. These narratives justify taking positions as well as providing marketing material to attract and retain investors. Though they should be used as a guide to a destination, we also use them to backfit a story to price moves after the fact. At the time of the move itself however there was no clear reason for it. Everything suddenly becomes clear in hindsight. This fits a need to always have answers with a real fear of admitting that you may not know something.

The prevailing narrative at the time of writing in my view is that inflation has peaked and that we are very close to the end of the hiking cycles globally. The central bank that matters most to the world is the Fed and they seem to indicate that fewer hikes are going to be necessary going forward to combat inflation. The market reaction has been to receive rates, sell dollars, buy credit and to sell commodities. I will touch on the last of these later. A recession is being priced in with increasing probability as the yield curve, a lead indicator, continues to invert. The debate around when and how deep it will be is gaining more traction. What isn’t really debated in my view is how central banks and other policy makers will respond in such a scenario. This is partly because the belief is that a recession from here will be very similar to ones experienced in the past. The cure for which is easier policy rates.

I subscribe to the view of a slowdown; however, it isn’t clear that the response function will be the same as slowdowns past.

2yr versus 30yr swap rate in USD

Source: Bloomberg

Adam Tooze, a history professor at Columbia University, has described the current environment that we are in as a “polycrisis”. I understand this as being lots of issues in different areas of the world that interact to more or less of a degree through feedback loops, creating a very complex environment. I am nowhere near as smart as Adam. I agree that the world we are in is complex. However, I draw this down to the interaction between geopolitics and economics. The former having more influence over the latter since any time I can remember during my short career. Investors are increasingly going to have to learn to navigate these interactions and carefully consider the motivations and incentives certain actions cause and the feedback loops they will create. In short, be prepared to deal with things that many of us may never have experienced before. More importantly, I think we are going to have to be willing to hear about and consider outcomes that are not necessarily part of the traditional outcome set that the market is currently considering.

The conflict between Russia and the Ukraine has impacted the world in ways which I think are still to be experienced. The most recent action that is being considered by the West, is placing a cap on the price of Russian oil in the market. Initial talk is between $65 and $70 USD which is meant to be above the cost of production.

Russian oil 1m forward(URALS)

Source: Bloomberg

One of the books that I had the privilege of reading this year was Basic Economics by Thomas Sowell. (https://www.amazon.co.uk/Basic-Economics-Thomas-Sowell/dp/0465060730). I highly recommend this to anyone that has not read it.

There are two main points which I took away. The first is to consider the full context of policies upon all relevant parties. The second is to think about the incentive structures that are created through policies. Indeed, any time that caps have been introduced by governments to protect consumers, producers are no longer incentivized to produce and output typically falls. Caps keep demand higher than it would otherwise be. Increased demand and reduced supply leads to pent up price pressure, which is temporarily subsidized by government. Eventually caps must be removed, usually for fiscal prudence and prices go back up again. Mr Sowell points to rents in NY as an example and I can more recently point to Argentina capping prices of power which has partly led to where the economy is today.

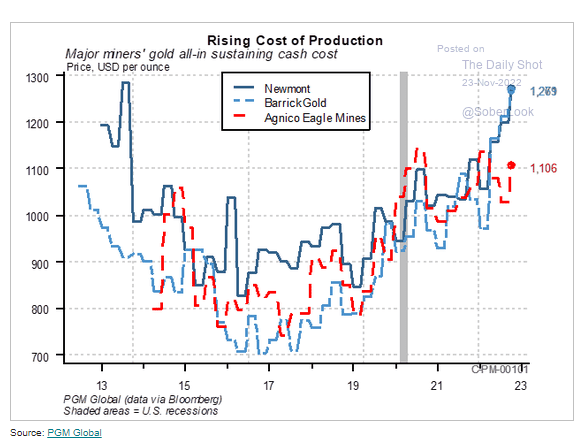

The Russian cost of production is estimated to be around $40 a barrel. But this number is very difficult to calculate with any accuracy (https://www.nytimes.com/2022/09/16/business/russian-oil-price-cap.html). Hence. the initial range around the cap was talked in the $40-$60 range. Given that it is not clear what the cost of production is, I cannot agree with statements which state the proposed cap is “above cost of production”. I was looking at the Dailyshot publication and came across this interesting chart about the cost of production for gold:

It begs the question of whether cost of production for oil companies and Russia in general have not also risen. I am sure that they rely on technologies from abroad in their process. Technologies which they may not be able to access anymore and if they are, are probably more expensive despite the performance of the Ruble. So, we may be underestimating the cost itself which means any cap may hurt margins more than anticipated. This is one of the errors that people implementing caps make and is highlighted in Mr Sowell’s book. That people often have no idea about costs of production when implementing them. They are put in place to show that something is being done without any thought to the practical implications.

The current argument is that Russia must continue to supply oil to the market in order to make money. Money that would be used domestically and to continue the war efforts. The idea of setting the cap above the cost of production would be to incentivize production thus allowing money to be made, albeit to a lesser degree. Thus, Russia should be motivated to continue producing. At the time of writing, the cap was still being debated. The implementation of various caps is meant to take place from the 5th December 2022 which is one day after the OPEC+ meeting. I do not agree with a cap motivating Russia to keep producing. I was looking online and found this link from TELESUR, a Venezuelan new site: https://www.telesurenglish.net/news/Russias-Response-to-EU-Price-Cap-Reorientation-of-Oil-Exports-20221006-0018.html. Granted the source is bias, but the wording is very clear. It seems any impositions of caps at any price on Russian products will mean that supply will be taken off the market. I must ask myself who has leverage in this situation.

If Russia were to take supply off the market in oil, with no production increase planned from the rest of OPEC, we would likely experience an aggressive move up in prices which will severely impact the world. Oil has fallen 30% from its highs earlier this year as people assume that growth is going to slow. There have been energy caps introduced across Europe to ease cost of living crises and now talks of gas prices being capped in markets has begun to take shape.

“The Commission is looking to propose an intervention tool (“Market Correction Mechanism”) when TTF is above 275 EUR (for 2 weeks) AND LNG spread is greater than 58 EUR (for 10 days). This still needs approval from national governments.” – Major US investment bank

The US has drawn down on the SPR to prevent gasoline prices increasing. This was mainly done for political reason ahead of mid-terms. The draw was roughly 400m barrels, which will need to be replaced. A lower oil price certainly helps with the potential of replenishing the reserve, but it leaves a very clear buyer in the market that may support prices. It also won’t be lost on Russia that this is the case. The SPR will grab more attention should we have an increase in flat prices. Saudi Arabia did cut production at the last OPEC+ meeting angering the US administration who have promised reprisals. Recent stories about a supply cut at the December meeting have been denied leaving the move in December unclear to me.

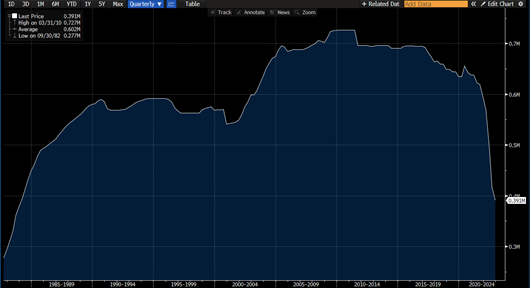

SPR Reserves

Source: Bloomberg

Average US Gasoline prices

Source: Bloomberg

Despite all the efforts to prevent consumers and businesses feeling the entire effect of the price rise, it seems we are still very concerned about what may happen with respect to energy. I am worried that Russia further weaponizes oil to force conditions from the rest of the oil consuming world. Where that may take the price, I am not too sure, but I doubt it will be lower.

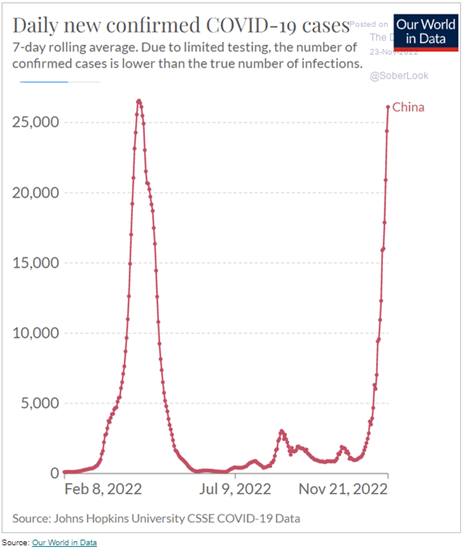

A lot of focus is once again being placed on China locking down due to increases in cases of Covid:

As we approach winter in the northern hemisphere and given China has reduced restrictions around Covid, it is only natural that cases begin to increase. At the time of writing several areas have been placed back into lockdown, including Beijing. China has also just cut the Reserve Requirement Ratio (RRR )by 25bps.

The media and the market have been fixated on China staying in lockdown. On initial talks of China opening, commodities, particularly industrial metals moved higher as did ETFs such as KWEB US. High yield property bonds rallied anywhere from 10 to 30 points. What has not happened so far on renewed lockdown rumours is a return to the lows in these assets. Perhaps we are now passed peak China lockdown risk. If true then the real asymmetry is that China does open up and experience the increase in demand that we have. This will be broadly inflationary for the world and will probably be coming at the least helpful time as policy makers elsewhere attempt to keep policy rates from moving higher.

KWEB ETF

Source: Bloomberg

The connotations of this are enormous. Looking at inventory of aluminium for example on LME, we are at record lows. Any sustained increase in demand will cause a rally which I feel we are ill equipped to deal with. Supply for many metals has been drastically reduced due to energy cost increases. Aluminium being one of them. Any recovery from China should see a draw of resources Eastward at a time when there is little in terms of supply coming and decreasing/low inventory. This may cause cost push inflation to remain at higher levels.

In my view the market would like to have a locked down China to push the lower inflation and growth narrative. A deflationary impulse from them would be ideal to push rates lower and risk assets potentially higher. The true tail risk here is that this does not happen, and China opens up faster than expected. Or the reaction function of asset prices is not as aggressive to the downside as in previous episodes.

China 1yr1yr rates. Will they move lower again from here?

Source: Bloomberg

Aluminium reserves on LME

Source: Bloomberg

The lower-than-expected CPI print in the US this month resulted in a very large rally in fixed income.

US 10yr bond yields

Source: Bloomberg

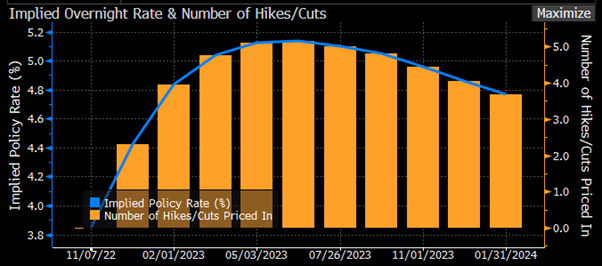

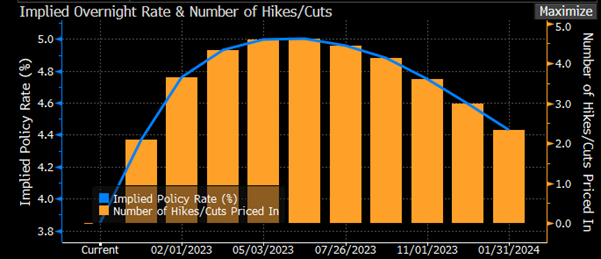

Terminal rate expectations and the path of rates changed dramatically over the month. The first and second charts below are rate expectations on the 7th of November and the 24th respectively. The terminal rate is now expected to be lower than at the start of the month and more cuts are also expected to occur part way through next year

Rate expectations 7th of November

Source: Bloomberg

Rate expectations 24th of November

Source: Bloomberg

The resulting performance in assets has seen a significant easing in financial conditions. Perhaps not what the FED wants to see as easing conditions may feed back into inflation expectations moving higher.

GS US Financial Conditions Index

Source: Bloomberg

The labour market also remains strong with unemployment still near record lows. Though activity is certainly slowing, there seems to be no significant increases in unemployment save for perhaps the tech space due to the moves in crypto currencies and the increase in rates so far. At the same time the fall in gasoline prices from the highs has been interpreted as equivalent to a “tax cut” by some. This renders disposable income higher for consumers meaning more spending power. Drastic reductions in growth may therefore be misplaced at this stage. Corresponding cuts in rates may also be unnecessary as a result.

One thread that runs through the above 3 themes that I think are most prevalent currently is commodity prices. What we have experienced so far is an inflationary impulse fueled by a combination of increased fiscal spending due to covid, easy monetary policy and pent-up demand. As supply chains began to unclog, the inflation that was building in the system was released. Central banks around the world have attempted to get in front of the problem with tightening monetary policy. The rationale has been to increase rates enough such that demand can fall to match supply so that prices do not continue to move higher.

I feel that inflation is a subject that isn’t generally well understood. I put myself in this category and am trying profusely to improve my knowledge. Inflation disproportionately affects people lower down the income spectrum and is as much a psychological phenomenon as an economic one. The latter point is demonstrated by the decade long deflation experienced by Japan and the exceptionally rapid and aggressive response to getting in front of inflation by EM central banks. Jerome Powell, the Chair of the Federal Reserve, for all his faults, has been very clear in the approach that the FED is attempting to take. Though they may decrease the pace of rate hikes to 25 or 50bps at a given meeting, they have no intention of stopping rate hikes till they feel that inflation is becoming well anchored. The fear of stopping too early is a much bigger risk in their view. I agree with him and therefore think that the terminal rate discussion is much more important than the pace of rate hikes.

The US does not exist on its own however and will be subject to dealing with very complex feedback loops from some of the ideas I have mentioned above as well as others. I have not touched on widening credit spreads and the increasing number of EM sovereigns falling into distress for example. Any increase in oil prices, which is my base case, and then corresponding commodities as a result would result in rates needing to go much higher in the US and everywhere else as a result in my view. This would also cause political strife to increase, just as we are starting to see in Europe.

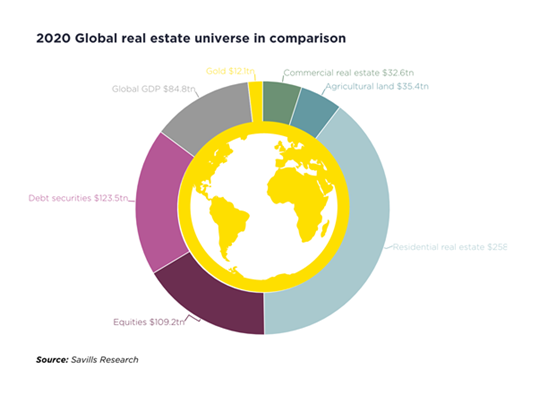

The main issue with increasing rates is that it affects property. The chart below from Savills by way of Adam Tooze is very insightful:

At 258trn USD in value in 2020, circa 20% each in US, EU and China, we can begin to get a scale of the problem the property market poses to policymakers. China has already had a pretty decent correction. Here in the UK, as rates have been increased, and are set to keep going up, we are still to experience what the housing market will do in response next year as floating rate mortgages reset higher. It is going to be very interesting to see how this tightrope is walked.

If the scenario I paint does manifest, then one of Thomas Sowell’s famous quotes firmly sits at the front of my mind; “there are no solutions, simply trade-offs”. Whether policymakers decide to tackle cost of living from input prices at the cost of housing or the other way round remains to be seen.

During 2020, the COVID lockdowns and subsequent recession was profitable for the East Sea Opportunity Fund and many other macro funds. Looking back however, I think that we were lucky in that we had bearish positions on at the right time. Just as everyone became a COVID expert, and then claimed they had foresight into how bad things would get, I am sure the same people will be weather experts over the coming weeks with the WFOR Bloomberg function being the most followed. I stand with the truism that it is better to be lucky than smart and am comfortable in saying we were fortunate more than skilled.

The biggest lesson from 2020 however was the need to be open minded in terms of what can happen. Prior to COVID, If I had told you that democracies across the world would willingly submit to being lockdown with no significant protests for months on end, you would not have believed me. From 2007 to 2020 every slowdown was met with the same formula and investors were lulled into a false sense of confidence in their understanding of how the world works. Low rates and QE were the panacea to every problem. What the past 12 months or so has shown is that things are changing. Save for a depression, I cannot see us going back to the methods of old. And even then, I am not too sure that it would be the correct prescription. QE and fiscal spending taught us that we can magically create wealth. However, if the issue is a lack of commodities or “stuff” as I like to call it, then this game won’t work. I fear this is where we are headed to.

If you have come this far with me, well done! If you must take one thing away from all this, it would be to keep an open mind.

Good luck!

*****************************************************************************

Quay Partners Group is a service-as-a-platform investment management solutions for independent hedge fund managers and family offices.

Supun Ekanayake is a Partner at Quay Partners Investments (UK) LLP and has over 15 years’ experience trading across all asset classes.

To learn how Quay can guide your business to success… get in touch with Us